PAYE and other employment tax to manage

Whether you’re a small business owner with several staff or a mid-sized enterprise with a team of 20, managing employment tax can often be a time-consuming, confusing and a stressful task – making pay-day anything but simple.

In New Zealand, employers are responsible for calculating and deducting income tax from their employees’ salaries and wages. This is called PAYE, or pay as you earn.

Each pay period you must calculate and deduct PAYE income tax from any earnings you pay a staff member – and then pay those deductions to Inland Revenue on their behalf.

While many employers choose to use intelligent payroll software like MYOB Essentials to calculate and pay their staff correctly, it’s still important for every employer to have an understanding of what PAYE is and how it works in New Zealand.

Whether you’re paying a staff member for the first time or are well-seasoned in the pay-day procedure, follow these 5 simple steps to manage employment tax with ease:

- Register as an employer

Before you can pay anyone for their work and/or time, you must register as an employer with Inland Revenue. It is a simple online procedure which only takes about 20 minutes. Once you’ve registered, your application will be processed in about 9-10 working days. - Make sure your employees have given you the correct information

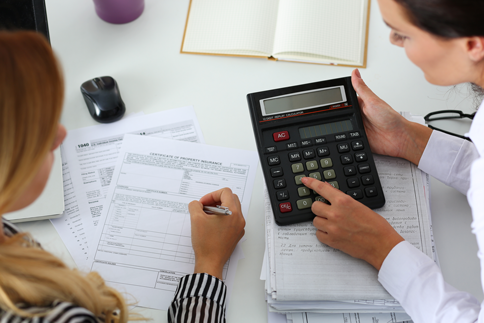

Every employee must supply you with their relevant tax code and a completed tax code declaration form. When paying your staff, you apply their assigned tax code to ensure they’re taxed at the correct rate.

You’ll also require their Kiwisaver information (if applicable), as well as other details about things like student loans and/or child support payments. - Work out PAYE each pay period, and deduct from salaries and wages

When it comes to pay day, you can either use payroll software or the IRD PAYE calculator to work out how much tax to deduct from your employees’ salaries and/or wages based on their tax code and other deductions. - File returns and pay deductions to IRD

Once you’ve calculated the deductions and have paid your staff correctly, you’ll need to file an Employer Monthly Schedule and return an Employer Deductions form to the IRD. You’ll need to do this each month – so keep the paperwork saved on your server, or have some printed ready for use. - Keep records

The IRD requires every employer to keep PAYE records for up to 7 years. So, before you delete any files, or shred any paperwork, make sure you’ve saved each employees’ payment history for up to 7 years.

Other things to consider:

Holiday pay

Holiday pay is included as earnings in the pay period that you pay your employees. If holiday pay is paid in the same period as normal pay, it is classified as salary/wages and will be taxed at the same rate as normal income. Holiday pay that is paid on top of normal pay is classified as extra pay and will be taxed as extra pay.

Bonuses

Lump sums like bonuses are taxable and are taxed depending on the type of bonus. Extra pay includes things like annual bonuses or gratuities, as well as retiring and redundancy payments. If you’re unsure of how to tax extra pay, speak with the IRD or an accountant.

Overtime

Overtime is taxed at the same rate as normal pay and is included in the same pay period.

Child support

The IRD will inform you if you need to deduct any child support payments from your employees’ earnings, as well as how much to deduct. Child support payments are deducted before all other deductions.

Student loans

Employees’ with student loan repayments will have a different tax code to other employees. If they have a student loan, you must deduct the appropriate rate from their earnings after you have deducted any child support as well as PAYE tax.

Make your PAYE obligations easier with MYOB Essentials Payroll and Try For Free. Have the peace of mind that your payroll calculations are correct, staff wages and PAYE payments are made and your IRD reports are automatically lodged on time.